Should You Refinance Your Mortgage? Pros and Cons

Should You Refinance Your Mortgage? Pros and Cons

Are you considering refinancing your mortgage? Don't make the decision till you have weighed all the pros and cons.

Obtaining a mortgage is a lengthy process, and once you have already been through it, you may not want to restart again. However, as a homeowner, you should be thinking about the future and if there is anything you can do now to save yourself money in the long run.

Many homeowners with a mortgage will refinance to shorten their term, lower their mortgage rate, or reach their financial needs. However, it would be best if you weighed the pros and cons in order to avoid any common mistakes as a homeowner.

Finding the right mortgage and lender with the best rates and costs is vital. Luckily, if you are debating refinancing, then you have already been through the process, and it shouldn't be quite as difficult as before.

Check out our guide on the pros and cons of refinancing your mortgage to make the best decision to save you the most money.

Keep reading to learn all about the pros and cons of refinancing your mortgage.

Pros

Refinancing has many major benefits, but it will all vary depending on the terms of your refinance and your financial goals. Ensure you efficiently weigh the pros and cons before making any major decisions.

1. You Could Spend Less Over The Life Of the Loan

The main goal of refinancing your mortgage should be to save money and reach your financial goals. If you shorten the time to pay off a loan, you will be shortening the amount of time you pay interest on the loan. If you obtain low refinance rates, you might be able to lower your interest rate.

You should only refinance if the market interest rate decreased since you bought your home. This would mean that you can get a lower interest rate, meaning lower payments and less interest paid over the life of the loan.

If you shorten the loan term, you may end up paying more monthly, but it can reduce the total interest over the life of the loan. Keep in mind that refinancing will include closing costs, consider your financial goals, and how long you plan on staying in this home.

2. Lower Interest Rates and Monthly Payments

The primary reason people decide to refinance is to lower the interest rate, which in turn lowers your monthly payments. You could then use the extra money towards other assets or pay the same amount as before. If you pay the same amount, you will shorten the life of the loan as well.

Outside conditions like market trends, economic conditions, etc, impact most mortgage interest rates. If you find that interest rates are lower than the rate on your current mortgage, it may be time to refinance.

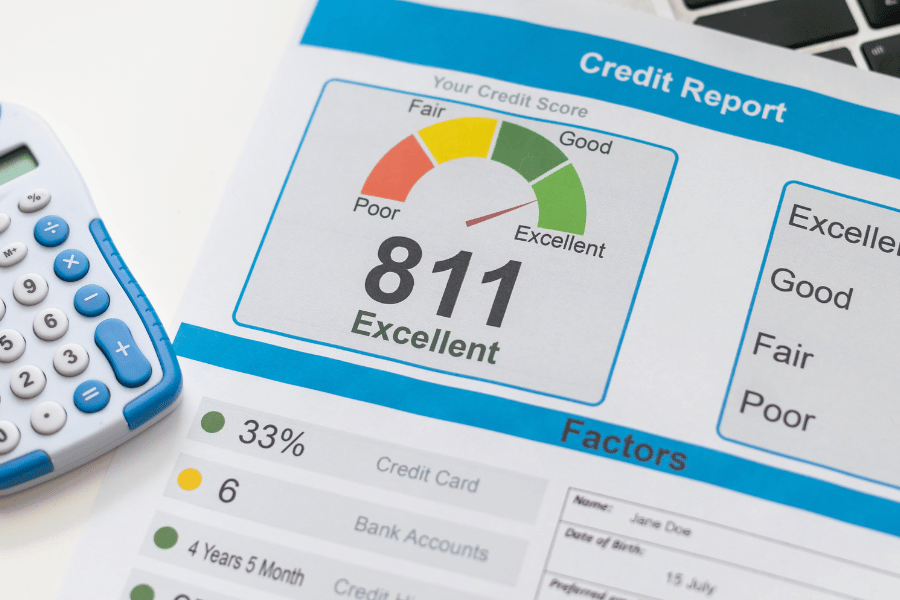

If your credit score has improved, you should consider refinancing to lower your current rates. You could change the term of your current mortgage from a 30-year term to only 15 years.

3. More Predictable Payments

You may want to refinance your mortgage to obtain a fixed-rate loan where your interest rate will stay the same. This way, your monthly payments will become more predictable, and you can build a more accurate monthly budget. You could refinance to a reverse mortgage to save on payments.

Homeownership means discovering hidden costs, and you'll be much better off if you can rely on a predictable mortgage payment.

4. Benefits Of Cash-Out Refinancing

Many homeowners switch to cash-out refinancing, which is when a homeowner refinances for a greater amount than their current loan balance. Homeowners do this to keep the difference between the new mortgage and the existing loan balance in cash.

You will need to have built-up equity in your home before considering cash-out refinancing. A lender will look over your credit score, debt-to-income ratio, and the appraised value of your home before approving your application.

According to the Consumer Financial Protection Bureau (CFPB), cash-out refinances became much more common in 2022 as interest rates increased.

Most terms of your current mortgage will vary, including the interest rate and loan term. This type of refinancing is best for homeowners who need the extra funds for other purposes. Depending on your long-term goals, cash-out refinancing might be the best option for you.

5. You Could Pay Off Your Loan Faster

In addition to spending less over the life of the loan, refinancing could set you up to pay off your loan faster. This might mean that you would need to pay more each month towards the loan, but you could switch from a 30-year loan to a 15-year loan. You should focus on if this route would help you reach your financial goals faster.

Without a mortgage or interest payment, you'll be able to spend that extra cash on things you really want to spend it on. This is the real goal when it comes to homeownership.

Many homeowners refinance to set themselves up to make a large purchase in the future. If you are preparing to make a large purchase like a wedding, college tuition, or another major expense, you should consider refinancing once rates decrease.

Cons

Similar to the pros of refinancing your mortgage, the potential cons will vary greatly depending on the terms of your loan and financial goals.

1. Closing Costs

Closing costs will change drastically from state to state; luckily, in North Carolina, closing costs are lower than the national average at about 1.1% of the sales price. Closing costs include title fees, home appraisal fees, home inspection fees, transfer tax, homeowner's insurance fees, escrow fees, and loan origination fees.

When refinancing, you will need to pay closing costs of 2% to 6% of the new loan amount. However, you could potentially negotiate the fees down some, but it will all depend on your lender.

In some cases, you might be offered a no-cost refinance, which means the closing fees will be put into the amount of your loan. You should always compare rates, terms, and programs when choosing a lender.

Always calculate how long it will take you to reach your break-even point, including your closing costs and new mortgage amount.

2. Negative Impacts on Your Credit Score

As you refinance, you might see a negative impact on your credit score if the lender pulls a hard inquiry. A hard inquiry is used when the lender pulls your credit report from one of the three main credit bureaus: Experian, Equifax, or TransUnion. This may result in your credit score being lowered. A hard inquiry will stay on your credit report for two years.

This is an unavoidable con when you refinance, but it should be a temporary setback. Although, you should keep this in mind if your credit score is already on the lower side.

3. The Savings May Not Be Worth It

While refinancing can save you money, it may not always be worth the hassle. Refinancing is not a simple process; it will take a lot of time, effort, and potentially extra money to complete.

You must wait at least 12 months for a cash-out refinance, 210 days for an FHA or VA loan, and 12 months to refinance a USDA loan. Typically, it will take about six weeks to refinance a mortgage, and you will need to pay extra fees throughout the process.

This can add up to be more work than your first thought, and if you aren't gaining a significant amount of money by refinancing, then it may not be the best decision for you.

4. You Could Be Reducing The Equity In Your Home

Refinancing your mortgage doesn't have a direct impact on the equity in your home. However, certain factors would indirectly reduce your home equity.

If you choose a cash-out refinance, you will be borrowing against the equity in your home. For example, if you have $50,000 equity in your home and take $30,000 out as a cash-out refinance, you'll only have $20,000 equity remaining.

Equity in your home is influenced by many factors, such as your overall home value. If your home value has decreased since your current mortgage, the equity in your home may have decreased as well. Your refinanced mortgage will be based on the current value of your home. Make sure to evaluate your current home value when debating a refinanced mortgage.

5. The Fees

It is vital to remember that refinancing is not free; there will be many fees to pay, and your goal should be to at least break even. If the costs to refinance outweigh the money you'd save from your new mortgage, you should not refinance.

The fees will include an appraisal fee, title fees, lender fees, application fees, credit report fees, recording fees, and more. The average refinance closing costs are between $2,500 and $5,000. Closing costs are typically 2 to 5 percent of the total loan amount. Since you will be taking out a new loan, you'll be repaying many mortgage fees.

Methodology

We used information from many different sources to help determine the pros and cons of refinancing your mortgage. Most information was found on CNBC, the Consumer Financial Protection Bureau (CFPB), and CoreLogic. We researched how the pros may outweigh the cons while homeowner debate refinancing their mortgage.

FAQ: Should You Refinance Your Mortgage? Pros and Cons

Here are some commonly asked questions about the pros and cons of refinancing your mortgage.

Is it a good idea to refinance your mortgage?

The best rule of thumb to follow if you are debating refinancing your mortgage is to do it only if you can reduce your interest rate by at least 1%. This allows you to build equity in your home quicker.

Does refinancing actually save you money?

The point of refinancing your loans is to lower your monthly payments; it is recommended to ensure refinancing will or won't help you reach your financial goals.

Do you lose equity in your home when you refinance?

Remember that your equity position will vary greatly with home prices and the loan balance on your mortgage. But, you should not lose any equity in your home when you refinance.

What is a cash-out refinance?

A cash-out refinance means you will be paying off your existing first mortgage. This can mean that your new mortgage loan will have different terms, including different interest rates or longer/ shorter times to pay off your loan.

What is not a good reason to refinance?

You should not refinance if you have a long break-even period. This means the number of months to reach the point when you start saving is longer. Don't refinance to lower your monthly payment if that means you'll be spending more money in the long run.

Should You Refinance Your Mortgage? Pros and Cons - The Bottom Line

As you debate the pros and cons of refinancing, keep in mind that this is not a one-size-fits-all solution. You will need to carefully look over your current mortgage, market trends, personal budget, and long-term financial goals.

While debating refinancing a mortgage, many homeowners decide that moving may be the best course of action.

If you decide to refinance won't be best for you and start looking for a new home, consider Raleigh, NC, which is one of the fastest-growing areas in the country and has many beautiful homes for sale; you'll have to act fast if you want to buy your dream home in one of Raleigh's best neighborhoods.

Before buying your next home in the Triangle, contact one of our helpful real estate specialists, who are eager to help you find the perfect home. We know that buying a home can be overwhelming, so make sure you are prepared beforehand.

Ryan Fitzgerald

Hi there! Nice to 'meet' you and thanks for visiting our Raleigh Real Estate Blog! My name is Ryan Fitzgerald, and I'm a REALTOR® in Raleigh-Durham, NC, the owner of Raleigh Realty. I work alongside some of the best Realtors in Raleigh. You can find more of my real estate content on Forbes, Wall Street Journal, U.S. News and more. Realtor Magazine named me a top 30 under 30 Realtor in the country (it was a long time ago haha). Any way, that's enough about me. I'd love to learn more about you if you'd like to connect with me on Facebook and Instagram or connect with our team at Raleigh Realty. Looking forward to connecting!

Related Blogs